Apr 19, 2016

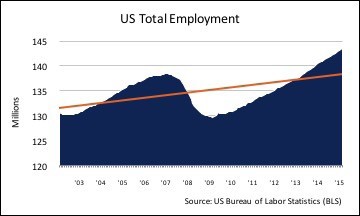

The performance of multifamily assets can be explained by the underlying macroeconomic variables that determine rental housing demand. First, as GDP growth has been sustained and positive since 2011, total employment in the United States has surpassed new records almost every month since May of 2014. In fact, monthly job growth has exceeded 200,000 in most months of 2015 and has persisted into 2016 with positive prospects to continue for some time. At present, the national unemployment rate is 5.0% as of March 2016 and job creation is occurring at an annual rate of 1.9%, according to the Bureau of Labor Statistics (BLS). Less reported is the improvement in the underemployment rate (the rate that includes part-time workers seeking full-time work and other similar situations); it has improved from a recessionary peak of 17.1% in 2010 to 9.7% in February 2016, showing the completeness of the jobs recovery as this number is close to its level of historical full employment.

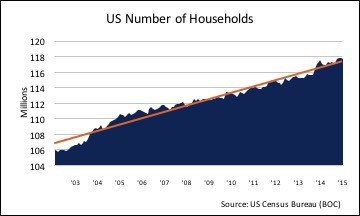

Job growth, along with natural population growth and net migration, has led to a record level of households in the nation. Household formation slows during recessions but tends to exhibit rapid growth during recoveries as pent-up demand is released. This can be observed in the U.S. Census Bureau data in late 2014 and 2015. The net effect is millions of new residents seeking housing, the majority of such will rent for many years prior to buying. Population growth and household formation trends are very stable and long lasting; thus it is rational to expect long-term, consistent growth in demand for multifamily housing.

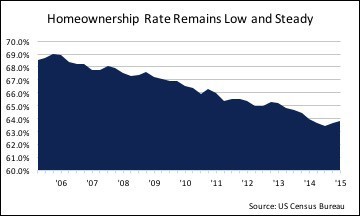

Naturally, there will be a mix of new housing dwellers that will buy versus rent. What determines the rent versus buy decision is a mixture of income, credit, savings, and life stage. The Millennials (generically those under 30) are one of the most dominant demographic cohorts today and are dramatically predisposed to renting given their allotment of the aforementioned income, credit, and savings. Further, many of this generation owe significant sums in student loans with relatively high monthly payments; the net effect of which is prolonged use of rental housing past the point where life stage suggests buying. The national homeownership rate it’s at 63.8%, close to recent lows, and struggles to gain despite the improved job situation and record low mortgage rates. Over time, this should move upward as millennials age and increase savings for down payments.